Approved Trader Scheme ATMS Scheme. Malaysia GST Reduced to Zero.

Goods And Services Tax Malaysia ZP.

. GST is a multi-stage tax on domestic consumption. Supplier provides transportation of goods that qualify as international services. However I notice SAP use only A for output tax and V for input tax.

Refers to all goods imported into Malaysia which are subject to GST that is directly attributable to the making of taxable supplies. The sales tax rate is at 510 or on a specific rate or exempt. Purchase from GST- registered supplier with no GST incurred.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. For more information regarding the change and guide please refer to. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. Overview of Goods and Services Tax GST in Malaysia.

Goods And Services Tax Malaysia NR. Exported manufactured goods will be excluded from the sales tax act. Charging GST at 0 the supply of goods and.

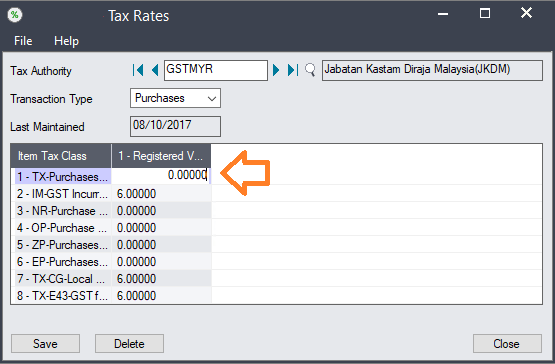

Malaysia GST Tax Codes. Tax codes determine how much tax is due for each transaction. 1 Government Tax Code.

A a taxable supply standard-rated or zero-rated. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. There are 23 tax codes in GST Malaysia and categories as below.

Goods And Services Tax Malaysia TX- N43. Segala maklumat sedia ada adalah untuk rujukan sahaja. Purchase from non GST- registered supplier with no GST incurred.

Import of goods with GST incurred. Malaysian sales and service tax. Export of goods from Malaysia to Designated Areas.

Malaysia are taxed at 19 on chargeable income up to RM 500000 with the remaining chargeable income taxed at 24. In the Malaysia government website the GST tax type proposed is GST. Goods And Services Tax Malaysia EP.

Secondly I notice the GST tax code listing have 2 3 or 4 characters however SAP standard provided 2 characters tax code only. To view the GST Tax Codes in MYOB open your company file then click. Malaysia GST Reduced to Zero.

GST Tax Codes in MYOB. What is the treatment. A GST registered supplier can zero-rate ie.

9 rows GST code Rate Description. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Purchases with GST incurred at 6 and directly attributable to taxable supplies.

Malaysia GST Reduced to Zero. There are 23 tax codes in GST Malaysia and categories as below. On 1 September 2018 SST is re-introduce to replaced GST.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. For purchases with input tax where the GST registered entity elects not to claim for it. For more information regarding the change and guide please refer to.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. 8 rows GST on purchases directly attributable to taxable supplies. GST is calculated on CIF Cost Insurance and Freight Customs Duty payable.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. So should I create a new tax type GST for this purpose. There are 23 tax codes in GST Malaysia and categories as below.

10 rows A GST registered supplier can zero-rate ie. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

For more information regarding the change and guide please refer to. Non-applicability to certain business. GST is suspended on the importation of goods made by a ATS holder.

IM 6 GST on import of goods. The existing standard rate for GST effective from 1 April 2015 is 6. GST on import of goods.

There are 23 tax codes in GST Malaysia and categories as below. GST code Rate Description. Input Tax 6 Import of Capital Goods.

GST is charged on all taxable supplies of. Supply of goods and services made in Malaysia that accounted for standard rated GST. Imports under special scheme with no GST incurred eg.

Complete Sst System Setup Guideline Help

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

The Brief History Of Gst Goods And Service Tax

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

How To Remove The Gst Summary From An Invoice Solarsys

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline